After an unprecedented rise to all-time highs during the pandemic shortage years of 2020 to early 2022, Singapore’s once-untouchable rents exhibited the first tentative signs of plateauing and decreasing modestly throughout 2022.

This marked a potential inflection point after a relentless uptrend fueled by chronic undersupply and ravenous demand from both expatriates and local residents alike.

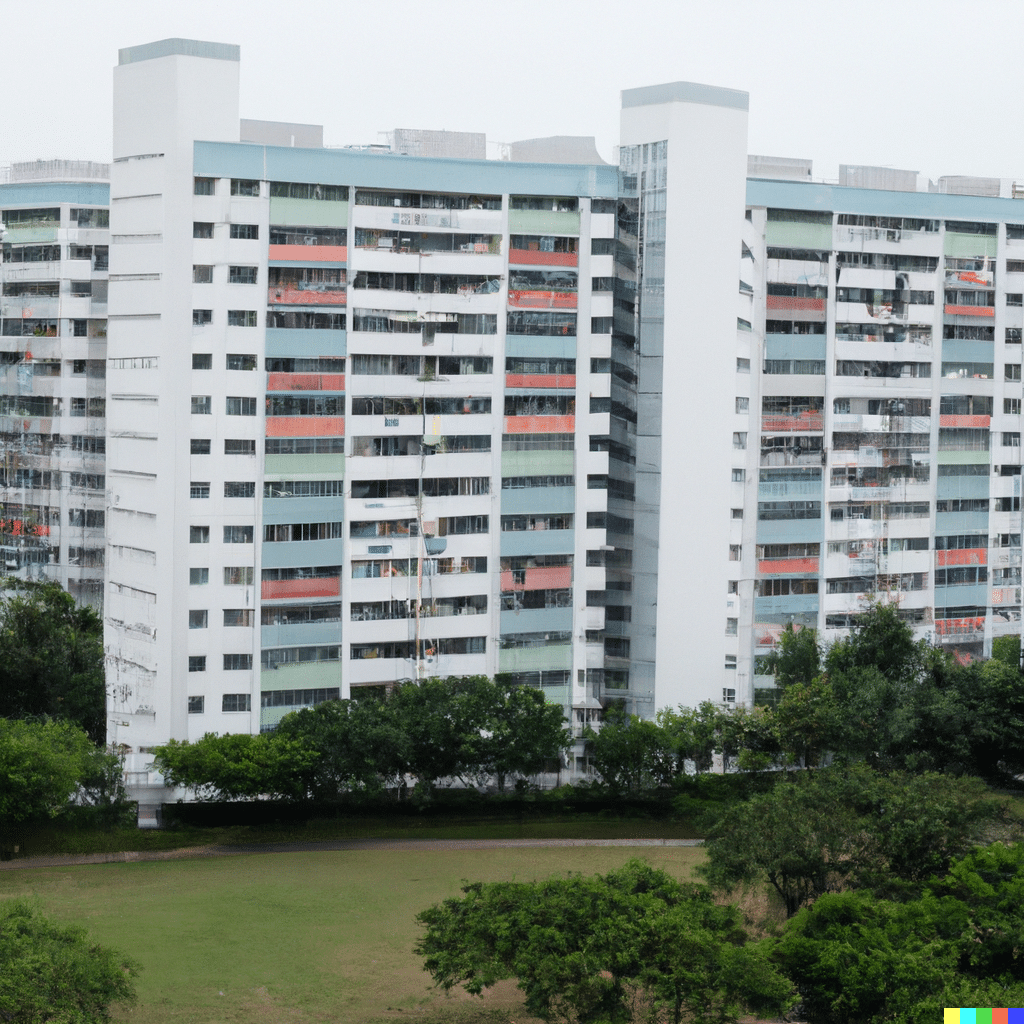

With cranes dotting the horizons and new housing supply steadily completing construction over the next five years, the question arises – will Singapore’s rental declines continue into 2024 and potentially accelerate as more inventory arrives on the market?

Let’s closely examine the key factors at play that will shape the trajectory of Singapore’s rental landscape in the coming year.

The Jaw-Dropping Pandemic Price Surge Starts Moderating in 2022

To appreciate the possible extent of rental declines in 2024, we must first understand the meteoric ascent of Singapore rents during the pandemic period.

Due to years of systemic housing shortages coupled with Covid-induced labor and construction constraints, rents for HDB flats, private condominiums, and landed housing rose a staggering 15% to 25% from 2020 to mid-2022.

This shocked tenants barely clinging to their units amid bidding wars, agents’ waiting lists, and ‘take it or leave it’ prices that had become detached from local incomes.

By early 2022, Singapore lay claim to the dubious honor of having the most expensive rental accommodations in the world according to surveys, eclipsing notoriously pricey cities like Hong Kong, New York, and San Francisco.

But the scene showed early signs of shifting by late 2022 as data trickled out showing the first quarterly declines in HDB and private home rents after more than seven straight years of ESCALATIONs.

While not indicative of a crash, this suggested the red-hot rental market was finally showing signs of fatigue and that long-suffering tenants may get some reprieve from endless price hikes.

Both HDB and private condo rents ticked down about 0.3% to 0.4% in Q3 and Q4 2022 respectively based on flash estimates, hinting that Singapore’s rental frenzy had peaked.

Anecdotal evidence aligned with the data, pointing to more listings staying longer on the market, selective price cuts on units, fading bidding enthusiasm at viewings, and gathering reports of landlords willing to sign annual contracts again versus insisting on short two- or three-year leases.

After the astronomical price increases of the past several years, many renters drew a sigh of relief and hoped the long-overdue moderation could gather steam into 2023 and 2024.

Key Factors That Could Extend the Rental Slide into 2024

Looking ahead, what key forces and scenarios could facilitate rents continuing to decrease at a modest pace rather than immediately bouncing back in 2024? Here are some of the core factors at play:

Ongoing Completion of Build-To-Rent Projects – The Singapore government aggressively rolled out development schemes for ‘Build-To-Rent’ (BTR) projects on state land aimed at boosting rental inventory after the shortages of the 2010s.

These large-scale projects undertaken by approved developers must allocate at least 70% of units for rental for a sustained period. Over 15,000 such BTR flats are slated for phased completion between 2022 and 2027.

As this new allotment of rental housing progressively arrives on the market over the next five years, it should incrementally help improve vacancy rates and absorption. While not a silver bullet, sustained additions to rental stock could facilitate further price declines or at least stall increases.

Stamp Duty Deterrents on New Private Homeowners – In 2021, the government instituted Additional Buyer’s Stamp Duty (ABSD) on the purchase of private homes if the owner then rents it out within three years of purchase.

This sought to discourage short-term profiteering by buyers flipping new condo purchases. By deterring some housing investors who previously bought new launches specifically to rent out, it reduced rental housing supply from private residential sources.

The impact may be secondary over time if owners rent out their units after three years, but dampens investor interest currently.

Potential Recession Impacting Rental Demand – After escaping the brunt of pandemic economic fallout, worries started brewing by late 2022 of an impending global recession as inflation raged and Western central banks hiked interest rates aggressively.

If economic pessimism translates into a sharp slowdown or recession in 2023-2024, how would this affect Singapore’s rental market?

Job losses or hiring freezes could force some expatriate families to depart if work visas or assignments are impacted.

Budget-conscious locals could also downgrade to smaller units or move back with families if retrenched. On the supply side, an exodus of foreign talent could also mean fewer newcomers vying for units. Both dynamics could soften rents amid lower demand and stationary population.

Stabilizing Post-Pandemic Conditions – The pandemic housing crunch peaked in 2021-early 2022 when borders were closed, construction was halted, and Singaporeans sought larger units for home-based work.

Once borders fully re-opened in 2022, allowing back foreign workers and freeing housing demand, conditions began normalizing.

As the dust settles into 2024 in a post-Covid world, demand may cool further if more companies cement hybrid work policies that facilitate employees moving further from the CBD core into the heartlands where space is abundant. Already rents in the CBD are exhibiting bigger declines as more formalize hybrid work.

Moratorium on HDB Rental Flats Expiring – During the pandemic, BTO-eligible flat owners were banned from renting out their whole HDB unit to prevent rental demand crowding out owner-occupiers.

But this temporary moratorium expires in 2023. On one hand, this re-allowing of HDB flat rentals could increase rental housing stock.

But on the other hand, owners may still hesitate to rent out their pricey flats bought at peak prices and with heavy mortgages currently. Much depends on their financial situations and apartment vacancies by 2024.

Key Reasons the Rental Decline May Remain Gradual

Given the above dynamics, why do experts still expect any rental decreases in 2024 to be modest rather than leading to a dramatic correction with rents falling off a cliff? Here are some mitigating factors that could keep the descent controlled:

Singapore’s Structural Housing Shortage – While Build-To-Rent development will provide some relief, let’s not forget Singapore has a chronic shortage of housing dating back decades due to land constraints.

Even accounting for pandemic overheating, rents had been rising for nearly a decade prior. The fundamentals of limited space and high population density hasn’t disappeared. An undersupply of 15,000-30,000 units by analysts’ estimates will take sustained effort to fully resolve.

Mortgage Rates Deterring Buyers – As mortgage rates rise due to global tightening, more Singaporeans are deterred from buying and opt to rent for longer.

Despite construction ramping up, strong housing demand remains from those priced out of purchasing. As long as renting stays comparatively affordable versus owning, rental demand should endure from this segment.

Solid Domestic Economic and Job Market – Despite global jitters, Singapore’s domestic economy remains resilient with a vibrant labor market.

Unemployment remains low while wages rise, especially for white collar roles. Fresh graduates entering the workforce are still receptive to striking out on their own. This contrasts with expats impacted by hiring freezes or departures. Locals provide an anchor of rental demand.

Rebound of Tourism and Foreign Students – Although travel remains below pre-Covid levels, Singapore’s phased border re-opening including the Vaccinated Travel Lane schemes have allowed tourists and foreign students to steadily return since late 2021.

If aviation fully rebounds in 2023-2024, a resurgence in short-term accommodation demand could replace any slack from expatriate departures.

Lack of Investment Alternatives – Beyond housing, there remain few attractive investment options for Singaporeans’ cash savings amid low interest rates.

This pools more funds into the physical housing market even at high prices. REITs also face low yields on local commercial assets currently. For yield-hungry investors, renting out homes remains appealing despite tax disincentives.

Wealth Effect from Housing – Despite recent declines, home prices remain elevated after the surge of 2020-2021 across both public and private housing.

Existing owners may be comfortable renting units out at breakeven or temporary loss given capital appreciation. Housing assets provide a buffer as landlords ride out any interim dip in rents.

Balancing the Mixed Signals

To summarize the crosscurrents in play – a brewing supply deluge, moderating post-Covid demand, and mounting economic uncertainty all signal Singapore rents could continue their downward trajectory into 2024.

But stubborn undersupply, still-strong local demand, and unabated investment flows provide countervailing forces that could buoy rents from any dramatic correction.

The interplay of these counterbalancing dynamics pointed to a Goldilocks scenario where rents decline modestly but not catastrophically, reverting to the steady, stable trajectory of the 2010s.

With Singaporeans highly invested in housing as an asset class, the propensity for riots or protests remains low despite any discomfort at rent drops after the irrational exuberance of recent years.

While lower rents improve affordability, rapid plunges are unlikely in the absence of severe depression given leadership’s prudent fiscal policies and sound capital controls.

As a small open economy, broader global economic health remains another variable in the equation. But Singapore’s resilient rebound from past downturns provides confidence that rents will evolve rationally rather than ricochet wildly even in periods of uncertainty.

Key 2024 Rental Market Forecasts

As we enter 2024, these are the latest market forecasts on Singapore’s rental trajectory for the year ahead:

- HDB rents to decrease 1-3% following the early declines observed in 2022 based on flattening demand and new BTO completions

- Condo and private home rents forecasted to decline up to 5% in 2024 as investors get priced out and white collar employment uncertainties persist

- Landed housing rents expecting modest 3-5% price softening given heightened stamp duties discouraging buying for rental income purposes

- Overall vacancy rates projected to increase from around 7% in 2022 to 8-9% in 2024 as supply growth outpaces demand growth

- Rents predicted to remain flat or at worst exhibit high single digit decreases for 2024, stabilizing at new equilibrium levels below the feverish pandemic bubble

Conclusion – a Gradual Return to Balance

In summary, while Singapore’s rental declines in 2022 were just the first tentative step, the conditions appear ripe for rents to exhibit further measured softening in 2023 and 2024. But the price drops likely remain mild rather than cascading into freefall.

Through a combination of supply growth via build-to-rent efforts, post-pandemic demand normalization, and targeted policy nudges, rents could return to more sustainable levels akin to the steadier 2010s over the next two years. With Singapore’s economy still thriving and massive public housing investments unlikely to be left vacant, excessive upside or downside lurches look improbable.

For beleaguered tenants seeking affordable housing, any degree of rental price relief even modest will be welcomed after the turbulent pandemic years. While economic uncertainty remains in 2024, the long-term outlook for Singapore’s real estate leans positive with diverse demand drivers and purposeful development planning by stakeholders. Singapore’s property ride looks bumpy but not devastating ahead.

Goh Jun Cheng is the chief staff writer for SingaporeAirport.com. Jun Cheng graduated with a degree in journalism from Nanyang Technological University in Singapore.

He has over 5 years of experience writing about aviation, tourism, and lifestyle topics relevant to locals and visitors in Singapore. His articles provide insights into the rich culture, cuisine, and attractions of Singapore. Jun Cheng is an avid traveler who has visited over 15 countries.

When he is not writing or traveling, he enjoys photography, trying new foods, and hiking. As a longtime Singapore resident, Jun Cheng is passionate about sharing hidden gems and perspectives about his home country.